top of page

Financial Insights

Practical guidance on markets, planning, taxes, and investor behavior—written for busy professionals who want clarity without jargon.

12 Smart Ways to Finish the Financial Year Strong

A simple year end tune up for real households. In a few clear steps, confirm your tax payments, capture every workplace match, decide on IRA and Roth options, make the most of HSA or FSA benefits, enroll for health coverage on time, and check whether the Saver’s Credit applies. We also touch on smart giving, using the 0% gains bracket, boosting 529 savings, and energy credits, so you start the new year organized and confident.

Gustaf Rounick, CFP®, ChFC®

Nov 6, 2025

Taxes, Trusts, and Giving: The Year End Strategy

A focused December roadmap for complex wealth. We cover the moves that matter before December 31—dialing in safe harbor payments, sequencing deductions, evaluating PTET, tightening trust administration, using the 65 day rule, optimizing charitable strategy, and selecting assets for lifetime exclusion gifts. Treat it as a menu, then coordinate with your CPA and attorney so cash flow, taxes, and giving all point the same direction for 2026.

Gustaf Rounick, CFP®, ChFC®

Nov 6, 2025

Unlocking the 20 Percent Pass-Through Deduction: Your Comprehensive Guide to Section 199A

Section 199A lets eligible pass-through owners deduct up to 20 percent of their qualified business income. This guide explains who qualifies, how the calculation works, and what the new One Big Beautiful Bill Act means for future planning—complete with a real-world example and actionable tax-saving tips.

Gustaf Rounick, CFP®, ChFC®

Oct 1, 2025

How Founders Can Defer Seven-Figure Gains with a QSBS §1045 Rollover

Startup founders holding QSBS for more than six months but less than five years can defer taxation on gains above the Section 1202 exclusion by reinvesting sale proceeds into new QSBS within 60 days. This Section 1045 rollover resets holding periods and basis, allowing eventual use of the full gain exclusion and indefinite deferral until the replacement stock is sold.

Gustaf Rounick, CFP®, ChFC®

Sep 1, 2025

Concentrated Stock Positions: Five Ways to Hedge Without Triggering Capital Gains

Holding too much of one company’s stock can jeopardize your wealth—and selling may spark a hefty tax bill. Explore five advanced techniques to hedge risk, diversify exposure, and defer capital gains while keeping your goals on track.

Gustaf Rounick, CFP®, ChFC®

Aug 23, 2025

Roth vs. Traditional: Choosing the Right Retirement Account for Your Situation

Should you pay the IRS now or later? This guide breaks down Roth and Traditional retirement accounts, contribution limits, phase-outs, RMD rules, and simple decision cues so you can pick the option that saves you the most over time.

Gustaf Rounick, CFP®, ChFC®

Aug 21, 2025

Solo 401(k) Compliance Calendar: Every Deadline & Form You Can’t Miss

Building your own business and retirement plan means juggling deadlines and forms. This Solo 401(k) Compliance Calendar outlines each critical IRS due date, from plan adoption to annual filings, so you can stay compliant and focused on growth.

Gustaf Rounick, CFP®, ChFC®

Aug 14, 2025

Guarding Generational Wealth: Trust Strategies to Keep Family Fortunes Intact

This in-depth guide explains why most fortunes fade after three generations and shows how tax-efficient trusts—from credit-shelter and QTIP to dynasty and SLAT—can preserve, protect, and grow family assets for decades. Learn how to pair the new $15 million federal estate-tax exclusion with proven trust structures to reduce taxes, safeguard control, and ensure your legacy endures.

Gustaf Rounick, CFP®, ChFC®

Aug 1, 2025

Mega-Backdoor Roth in a Solo 401(k): Step-by-Step Playbook

If you’ve already maxed out your $23,500 elective deferral (plus any catch-up) in your Solo 401(k) and still feel the itch to save more, you’re in the right place. The Mega-Backdoor Roth strategy lets you funnel up to the IRS’s $70,000 annual addition limit into after-tax contributions—and then convert them into Roth dollars for decades of tax-free growth. This step-by-step playbook walks you through plan setup, payroll withholding, conversions, and year-end filings.

Gustaf Rounick, CFP®, ChFC®

Jul 29, 2025

Tax-Loss Harvesting 2025: Turn Market Dips Into Long-Term Tax Savings

Market pullbacks don’t have to hurt. Discover how tax-loss harvesting converts temporary losses into real tax relief, protects future gains, and fits smoothly into a disciplined investment plan—complete with wash-sale guidance, crypto nuances, state quirks, and charitable giving hacks.

Gustaf Rounick, CFP®, ChFC®

Jul 22, 2025

Solo 401(k) or SEP IRA? Choosing the right self-employed retirement plan for 2025

Choosing between a Solo 401(k) and a SEP IRA in 2025 isn’t just about bigger numbers—it’s about matching contribution limits, Roth access, filing deadlines, and future hiring plans to your one-person business. This guide breaks down the rules, runs real-world examples, and flags common pitfalls.

Gustaf Rounick, CFP®, ChFC®

Jul 22, 2025

Smart College Savings in Los Angeles: 529s, Coverdell ESAs, Roth IRAs & More

From 529 plans to Roth IRAs, this guide breaks down every major college-savings option, compares tax perks, and shows Los Angeles parents how to mix and match accounts for K-12 through graduate school.

Gustaf Rounick, CFP®, ChFC®

Jul 21, 2025

New Tax Era, Bigger Deductions: Westlight Wealth’s Plain-English Guide

Westlight Wealth doesn’t wait for glossy headlines to settle—we dig straight into what new law means for your balance sheet. When...

Gustaf Rounick, CFP®, ChFC®

Jul 5, 2025

Venice Real-Estate Prices Slip in Spring 2025—What That Means for Your Long-Term Portfolio

Venice’s luxury‐coastal market is cooling: median listings dipped to $2.4 M in April 2025, gross rental yields have fallen below 1.5 %, and inventory is up. Between rising property taxes, new transfer‐tax brackets, and Proposition 13 quirks, now’s the time to rebalance home equity, secure flexible financing, and optimize your tax strategy. This post breaks down the key stats, policy impacts, and three actionable plays to stay ahead.

Gustaf Rounick, CFP®, ChFC®

Jun 24, 2025

Abbot Kinney Festival 2025: Turn Community Giving Into Tax-Smart Impact

Boost your Venice brand at the Abbot Kinney Festival: combine tax-deductible sponsorships with live marketing activations and vendor insights for growth.

Gustaf Rounick, CFP®, ChFC®

Jun 22, 2025

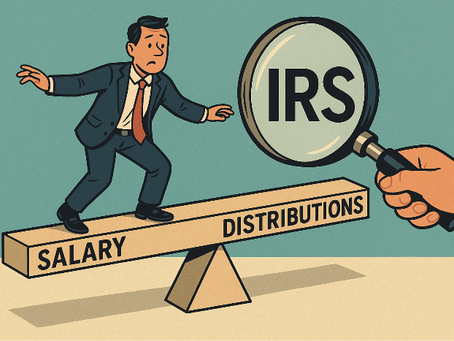

Los Angeles S-Corp Tax Guide 2025: How ‘Reasonable Compensation’ and California Rules Shape Your Self-Employment Savings

The Allure of the Shortcut Forming an S-Corporation is often pitched as an instant 15.3 percent* self-employment-tax savings. The pitch...

Gustaf Rounick, CFP®, ChFC®

May 15, 2025

bottom of page